Is sequence risk getting ignored?

Hear from Ben Edwards – Director at Albion.

Your clients are typically in one of two phases of their lives: accumulating, or decumulating. For the best client experience, both require the other to be done well to give the best chance of a client meeting their goals. This newsletter focuses primarily on the latter.

The issue of sequence risk – that is to say, how returns fall in the years over which an investor is investing – is a big and complicated issue. Yet, to a large extent, it is not something that the current generation of advice firms have had to deal with, recent markets have been relatively kind, and any market falls – such as 2007-9, 2020 and 2025 (so far!) – have recovered swiftly. Yet, it is a material, systemic risk that could come back to haunt the financial planning community if the future is not so kind.

There is great financial planning work being done and we are seeing increasingly more robust risk-factor-tilted portfolio construction, and stronger ongoing governance.

However, the critical intersection between these areas and a successful outcome is sequence risk. To address this, firms must design resilient and optimal drawdown strategies. These strategies should form a core part of Centralised Retirement Propositions, helping client assets generate a stable lifetime income while maximising the value of their resources.

Sequence risk means the order of returns matters when you are withdrawing money.

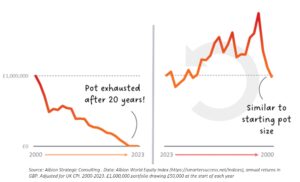

The impact of sequence risk

To demonstrate sequence risk, we consider the returns of a global equity portfolio from 2000 to 2023 with annual withdrawals – a period over which the pot would have been exhausted. Reversing the pattern of returns, an investor finishes with about as much as they started with. Imagine two clients with the same retirement objectives, two different journeys, two different outcomesHow can you mitigate sequence risk?

Advisers have a few tools to mitigate sequence risk for their clients:- Flexible spending rules (e.g. guardrails)

- Annuities

- Adjusting asset allocation as retirement nears

- Even the timing of your retirement can make all the difference – don’t underestimate sequence risk.